The Financial Planning Company’s investment strategy harnesses the power of low-cost indexing while making the conscious decision to overweight asset classes that consistently and robustly outperform the general market over long periods of time.

All of our investment portfolios are broadly and globally diversified.

Asset classes have distinct risk and return characteristics. We invest in the stock market because it has more risk and expected return than the bond market. We invest in the bond market because it has more risk and expected return than a savings account. Likewise, our portfolios lean towards small and value stocks because they have a higher expected return than the general market.

The chart below shows exposure of the U.S. Total Market compared to U.S. portfolios at The Financial Planning Company. As you can see, unlike the portfolio on the left, the portfolio on the right is diversified amongst style boxes and has more exposure to small and value stocks and less exposure to large and growth stocks.

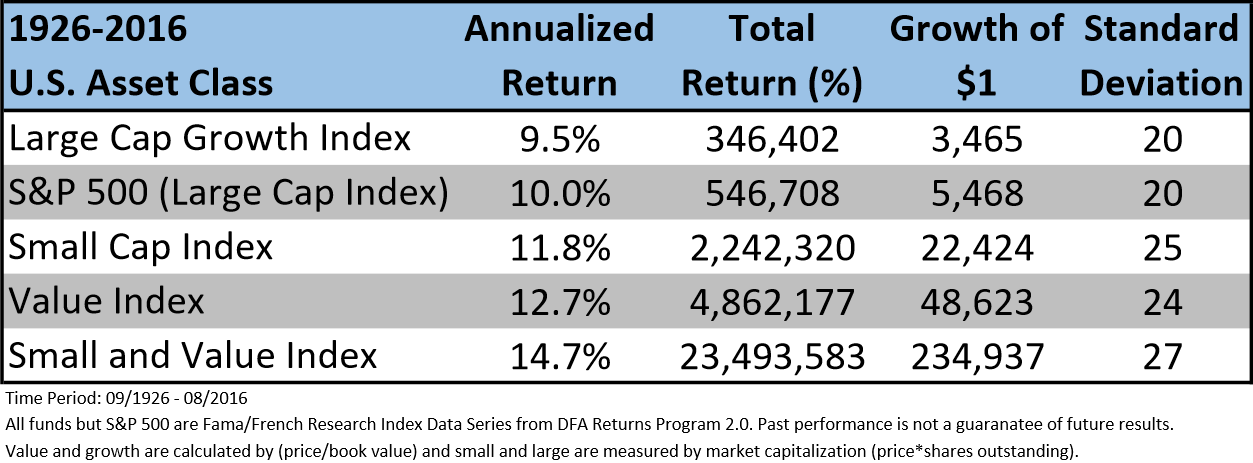

Maybe you’re thinking “so what.” Examine the table below and you will be blown away by one of the best-kept secrets in finance.

The outperformance of small stocks, value stocks, and the combination of small and value stocks is substantial.

To further stress the point we included a table that shows annual performance premiums for small and value stocks versus their lagging large and growth counterparts. Since 1928, U.S. small stocks have had a return premium of 2.28% per year over large stocks. During that same time period, U.S. value stocks experienced an even higher return premium of 3.44% per year over growth stocks.

As the table below shows, the longer your investment horizon, the more likely small and value stocks will outperform the general market (which holds large and growth stocks).

As part of the portfolio management process, we provide clients numerous services which include:

· Tax Efficient Asset Placement

· Tax Loss Harvesting

· Tax Conscience Trading

· Quarterly Portfolio Rebalancing

· Minimal Turnover and Trading

The Financial Planning Company does not focus on these often-overlooked investment details for our own advantage. Ultimately, everything we do is for the betterment of our clients; so they will be in a better financial position 3, 5, and 10 years from today.