Alternative Strategy Definitions

Absolute Return: Funds that aim for positive return in all market conditions. The funds are not benchmarked against a traditional long-only market index but rather have the aim of outperforming a cash or risk-free benchmark.

Equity Market Neutral: Funds that employ portfolio strategies that generate consistent returns in both up and down markets by selecting positions with a total net market exposure of zero.

Long/Short Equity: Funds that employ portfolio strategies that combine long holdings of equities with short sales of equity, equity options, or equity index options. The fund may be either net long or net short depending on the portfolio manager’s view of the market.

Managed Futures: Funds that invest primarily in a basket of futures contracts with the aim of reduced volatility and positive returns in any market environment. Investment strategies are based on proprietary trading strategies that include the ability to go long and/or short.

A Modern Look at Alternative Assets: Are High Fees and Low Expected Returns Worth the Correlation Benefits?

Given the availability of low cost and transparent stock and bond portfolios, the intended benefits of some alternative strategies may not be worth the added complexity and costs.

Diversification has been called the only free lunch in investing. This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility without reducing expected return or increase expected return without increasing volatility compared to those individual assets alone. Many investors have taken notice, and today, highly diversified portfolios of global stocks and bonds are readily available to investors at a comparatively low cost.

Some investors, in search of additional potential volatility reduction or return enhancement opportunities, may even try to extend the opportunity set beyond stocks and bonds to other assets, many of which are commonly referred to as “alternatives.” The types of offerings labeled as alternative today are wide and varied. Depending on who you talk with, this category can include, but is not limited to, different types of hedge fund strategies, private equity, commodities, and so on. These investments are often marketed as having greater return potential than traditional stocks or bonds or low correlations with other asset classes.

In recent years, “liquid alternatives” have increased in popularity considerably. This sub-category of alternatives consists of mutual funds that may start from the same building blocks as the global stock and bond market but then select, weight, and even short securities1 in an attempt to deliver positive returns that differ from the stock and bond markets. Exhibit 1 shows how the growth in several popular classifications of liquid alternative mutual funds in the US has ballooned over the past several years.

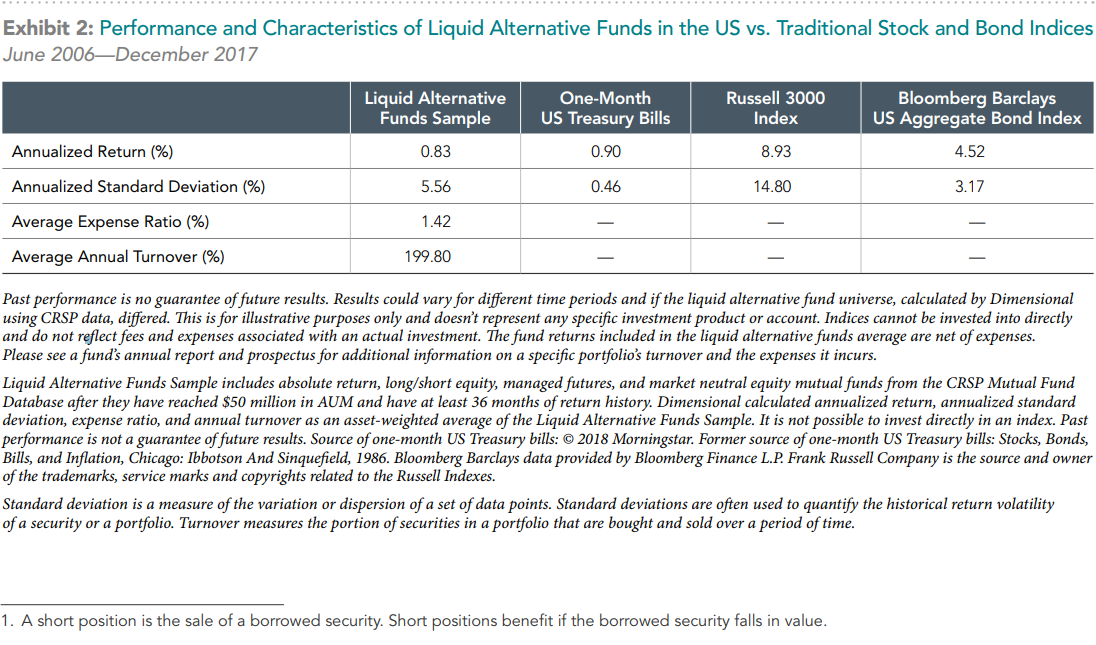

The growth in this category of funds is somewhat remarkable given their poor historical performance over the preceding decade. Exhibit 2 illustrates that the annualized return for such strategies over the last decade has tended to be underwhelming when compared to less complicated approaches such as a simple stock or bond index. The return of this category has even failed to keep pace with the most conservative of investments. For example, the average annualized return for these products over the period measured was less than the return of T-bills but with significantly more volatility.

While expected returns from such strategies are unknown, the costs and turnover associated with them are easily observable. The average expense ratio of such products tends to be significantly higher than a long-only stock or bond approach. These high costs by themselves may pose a significant barrier to such strategies delivering their intended results to investors. Combine this with the high turnover many of these strategies may generate and it is not challenging to understand possible reasons for their poor performance compared to more traditional stock and bond indices.

This data by itself, though, does not warrant a wholesale condemnation of evaluating assets beyond stocks or bonds for inclusion in a portfolio. The conclusion here is simply that, given the ready availability of low cost and transparent stock and bond portfolios, the intended benefits of some alternative strategies may not be worth the added complexity and costs.